This current antidumping and countervailing petition’s objective is to address market distorting, anti-competitive behavior that creates uncertainty for U.S. solar manufacturers and tens of thousands of American solar workers, while threatening our country’s energy security. A level playing field will allow U.S. solar manufacturers to compete and thrive on their own merits, safeguarding good-paying, family sustaining jobs. With a stable supply and pricing environment, we can drive deployment with sustainably made solar technology.

These cases run about a year from start to finish. The Commerce Department will issue a press release announcing they have initiated the investigation on day 20 (May 14) and issue a Federal Register Notice right after. The Commerce Department has 120 days (4 months) from initiation to issue a preliminary subsidy determination, and 190 days (6 months) from initiation to issue a preliminary antidumping determination. The ITC will begin a preliminary injury investigation almost immediately after the petition is filed. There will be an ITC staff conference with industry witness testimony on day 21 (May 15). The ITC will make a preliminary assessment on injury from imports on day 45 (May 25) and issue a press release.

The future of America’s cutting-edge solar industry is at stake for solar developers and manufacturers alike. The unfair and illegal trade practices of Chinese-headquartered companies via Cambodia, Malaysia, Thailand, and Vietnam are causing immense volatility and cost uncertainty. This denies our manufacturers the opportunity to compete on the basis of their merits and pricing and supply volatility makes it impossible for solar developers to plan for the future.

At a time when the U.S. government has created the foundation necessary to invest in the energy transition with the passage of the Inflation Reduction Act (IRA), we must also enforce our trade laws, so these investments support the Act’s strategic intent. The IRA presents a once in a lifetime opportunity to expand and secure the solar supply chain and catalyze investments in U.S. manufacturing and innovation in this important sector.

Without swift and effective enforcement of our trade laws, these investments will be for naught, and we will be dependent on Chinese companies to build our clean energy future.

The actual antidumping and countervailing duty margins will only be determined after a full investigation by the Commerce Department. It is important to note that the duty rates imposed on most companies could be lower than the rates listed below. Note, current Chinese AD/CVD rates range from 15% to 50% for most cooperating companies.

Companies that refuse to cooperate in the investigations, as well as companies in Vietnam (a non-market economy) that are found not to be independent of the Vietnamese government, could be subject to the rates listed below. Companies that refuse to cooperate in the investigations, as well as companies in Vietnam (a non-market economy) that are found not to be independent of the Vietnamese government, could be subject to the rates listed below.

Filing this type of case is the standard procedure and remedy for American manufacturers being harmed by dumped and subsidized imports. These kinds of cases happen frequently, involving products from paper plates to steel. There are more than 670 U.S. antidumping and countervailing duty orders in place today.

An antidumping (AD) and countervailing duty (CVD) case is a legal process used by the U.S. government to address unfair trade practices by foreign companies and governments. Specifically, dumping occurs when a foreign company sells a product in the U.S. market at a price that is lower than the price charged in its home market or at a price that is below its cost of production. This is considered an unfair trade practice that can harm U.S. companies and workers.

To address these unfair trade practices, the U.S. Department of Commerce can impose AD and/or CVD duties on imports. These additional duties are meant to “level the playing field” and offset the unfair pricing or subsidies. U.S. Customs and Border Protection is responsible for enforcing and collecting these AD and CVD duties on imported goods.

This is a helpful video from the U.S. Department of Commerce that explains why enforcement of our trade laws is important to support American industry and workers.

By law, these cases run about a year from start to finish.

To ensure that solar will continue to be accessible and affordable, we need domestic alternatives to a handful of state-backed companies in China. This case will help ensure the continuation and growth of a strong U.S. supply chain for solar panels. According to NREL, if the U.S. solar manufacturing plants that have been announced following the passage of the Inflation Reduction Act are built, American workers can produce enough solar panels and cells to meet our demand by as early as 2025.

These cases will ensure that the U.S. solar industry will be able to supply American homes and businesses with solar panels, independent from any conflicts with China.

Many foreign solar panels are being imported tariff-free because of a combination of Chinese based companies evading our trade laws and taking advantage of loopholes in our trade laws.

The IRA has provided critical support for the American industry, but it pales in comparison to the enormous subsidies and other incentives China offers to Chinese firms. The IRA tax credits for manufacturers only apply to U.S. goods sold – manufacturers need a market that is not distorted by dumping and subsidies to sell into before receiving these credits.

The intent of the IRA is to strengthen clean technology manufacturing and domestic production while we transition to a clean energy economy. If our trade laws are not enforced, it is highly possible the IRA will fail to deliver on manufacturing clean energy technology in America to the degree we can and must if we want to hit our climate goals, while derisking a critical value chain. It is also likely that we will become 100% dependent on Chinese companies for accessing solar technology, making us vulnerable to monopolistic pricing and supply chain access being weaponized to support the Chinese government’s geopolitical goals.

According to the Clean Energy Buyers Association, today solar panel manufacturing represents a small portion of global emissions. However, if global energy grids don’t get cleaner as solar manufacturing grows, the carbon emissions from manufacturing solar panels could exceed aluminum manufacturing by 2024. Currently, aluminum is the fourth most carbon intensive industry. Solar panel manufacturing will also be cleaner if done in the United States than if permitted to be dominated by Chinese-owned companies.

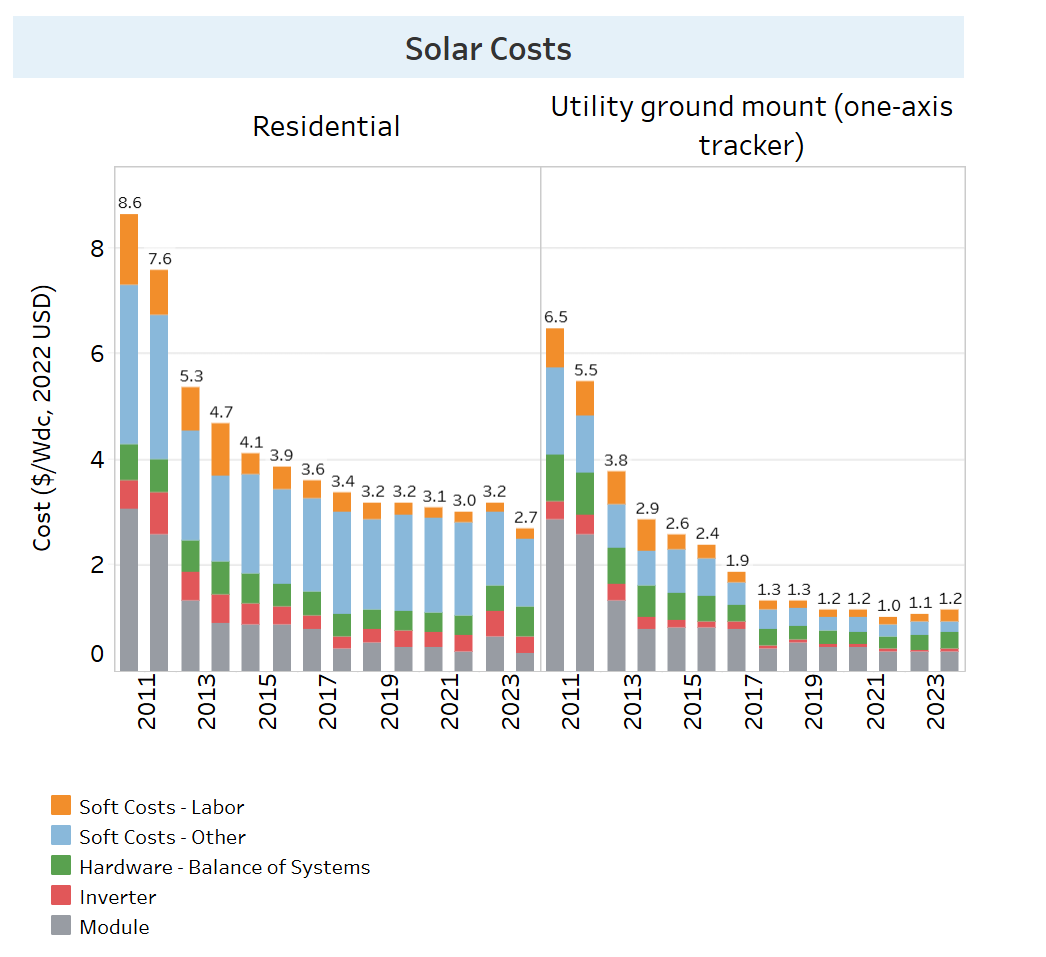

Solar panels make up only about 8% of the cost of a residential solar installation and less than 22% of utility-scale solar systems, according to a 2024 report by SEMA. Labor, permitting, customer acquisition, etc., are the costs that drive deployment decisions. According to a 2023 Bloomberg New Energy Finance (BNEF) report, the price of a standard solar panel hit an all-time low of 16.5 U.S. cents per watt in August 2023, and absent trade relief, prices are expected to fall further. In any case, solar system prices will be well below the price of fossil fuels. While low prices may seem attractive, these are artificially low. If Chinese companies secure a monopoly of the solar market, they will have full discretion over market pricing, destroying healthy competition.

Global spot markets are important indicators of where U.S. prices are headed. A public PV Insights report also shows that solar panel prices are as low as 10 cents/watt in China.

The real barriers to deployment are high interest rates, interconnection constraints, and transmission bottlenecks. The focus on solar panel prices is misplaced – one would not try to solve the housing crisis by making bricks cheaper. Similarly, solar panels are an inexpensive portion of the overall cost; making them in the U.S. will not slow deployment.

When we fail to defend our domestic economic policy, American jobs and industry suffer. After the economic collapse in 2008, the U.S. passed the American Recovery and Reinvestment Act (ARRA) in 2009 that included a 30% investment tax credit to spur American solar and clean energy manufacturing. China responded by pouring money into building factories and slashing solar component prices below cost and creating a near instantaneous monopoly. Within three years of ARRA’s passage, most American manufacturers shuttered due to unfair market conditions and the uneven playing field influenced by China’s anti-competitive, retaliatory actions. SEIA’s annual market reports between 2010 and 2013 illustrate the sudden shuttering of American facilities manufacturing at all stages of solar production: ingots, wafers, cells, and finished solar panels.

Following the passage of the Inflation Reduction Act and its historic investments in the clean energy transition, the solar industry is at a critical juncture for growth. According to a study by Dartmouth University, Princeton University, and the Blue Green Alliance, if all U.S. developers sourced 55% of its manufactured solar goods domestically, the solar manufacturing industry would support 900,000 jobs by 2035. That is a significant increase from the estimated 34,000 solar manufacturing jobs in the U.S. today.

The biggest factor holding back solar deployment is the enormous interconnection queue and workforce shortages. The best way to strengthen deployment is to have a vibrant, competitive domestic solar manufacturing industry, not a monopoly by Chinese-owned companies. Trade enforcement has never slowed deployment of solar panels in the United States.

The real risk for deploying solar at the pace our planet needs is a situation in which we are 100% dependent on Chinese companies for future deployment. This means that a foreign adversary would have complete control over pricing and supply chain for the cheapest and cleanest form of electricity.

Solar energy is already the cheapest form of energy and will be an increasingly important part of our energy generation and that of our allies. We shouldn’t trade our dependence on foreign oil with our dependence on foreign solar. Look no further than gas prices in Europe following Russia’s invasion of Ukraine.

There is tremendous business opportunity in solar; solar technology was invented in the United States, the United States once led in this industry, and we have an opportunity now to reclaim our global leadership.